Session 7 Volatility modeling in practice

7.1 The ARMA(1,1)-TGARCH(1,1) model

In this session we include the conditionally-heteroskedastic models into the ARMA framework. In particular, we consider an ARMA(1,1) model with conditionally-heteroskedastic innovations and asymmetric effects. For simplicity, we just consider first-order difference equations, but the model can be generalized to include more lags. The model is an ARMA(1,1)-TGARCH(1,1) of the following form:

\[ \begin{aligned} y_t &= c + \phi y_{t-1} + \theta \varepsilon_{t-1} + \varepsilon_t \\ \varepsilon_t &= \sigma_t z_t \\ \sigma^2_t &= \omega + \alpha \varepsilon_{t-1}^2 + \beta \sigma^2_{t-1} + \gamma \varepsilon_{t-1}^2 \mathbb{1}_{\varepsilon_{t-1}<0} \end{aligned} \]

Throughout this session, we consider \(z_t \sim \mathcal{N}(0,1)\) and we estimate the model via maximum-likelihood. Let \(I_t = \{y_1, \dots, y_t, \varepsilon_1, \dots, \varepsilon_t, \sigma_1, \dots, \sigma_t\}\). The log-likelihood of the model is:

\[ \ell(\theta; I_T) = -\frac{T-1}{2} \log(2\pi) - \frac{1}{2}\sum_{t=2}^T \log \sigma_t(I_{t-1}; \theta) - \frac{1}{2}\sum_{t=2}^T \frac{( \varepsilon_t(I_{t-1}; \theta))^2}{\sigma^2_t(I_{t-1}; \theta)}, \]

where expressions for \(\sigma_t(I_{t-1}; \theta), \ \varepsilon_t(I_{t-1}; \theta)\) can be found using a standard filtering procedure (Exercise 3).

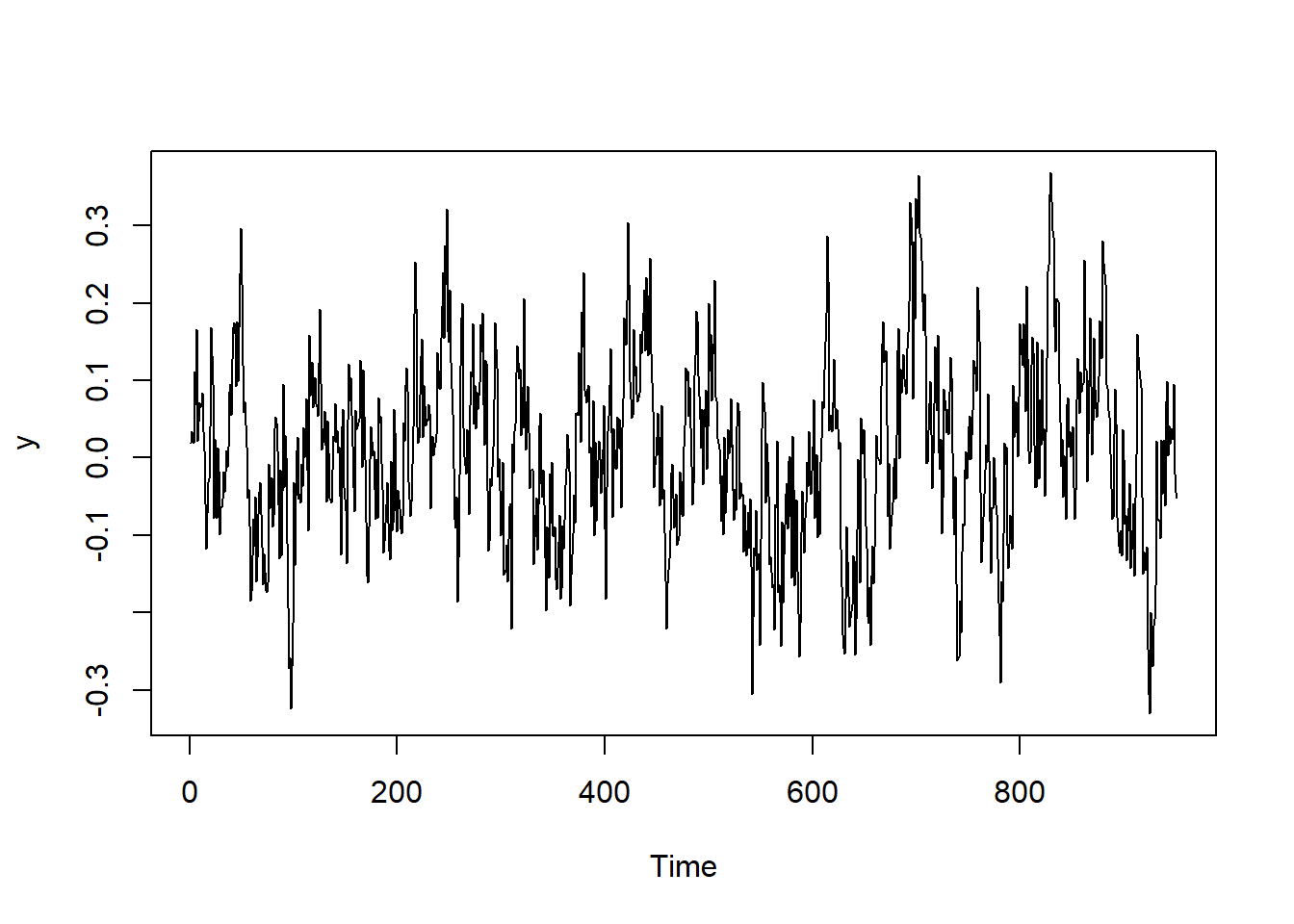

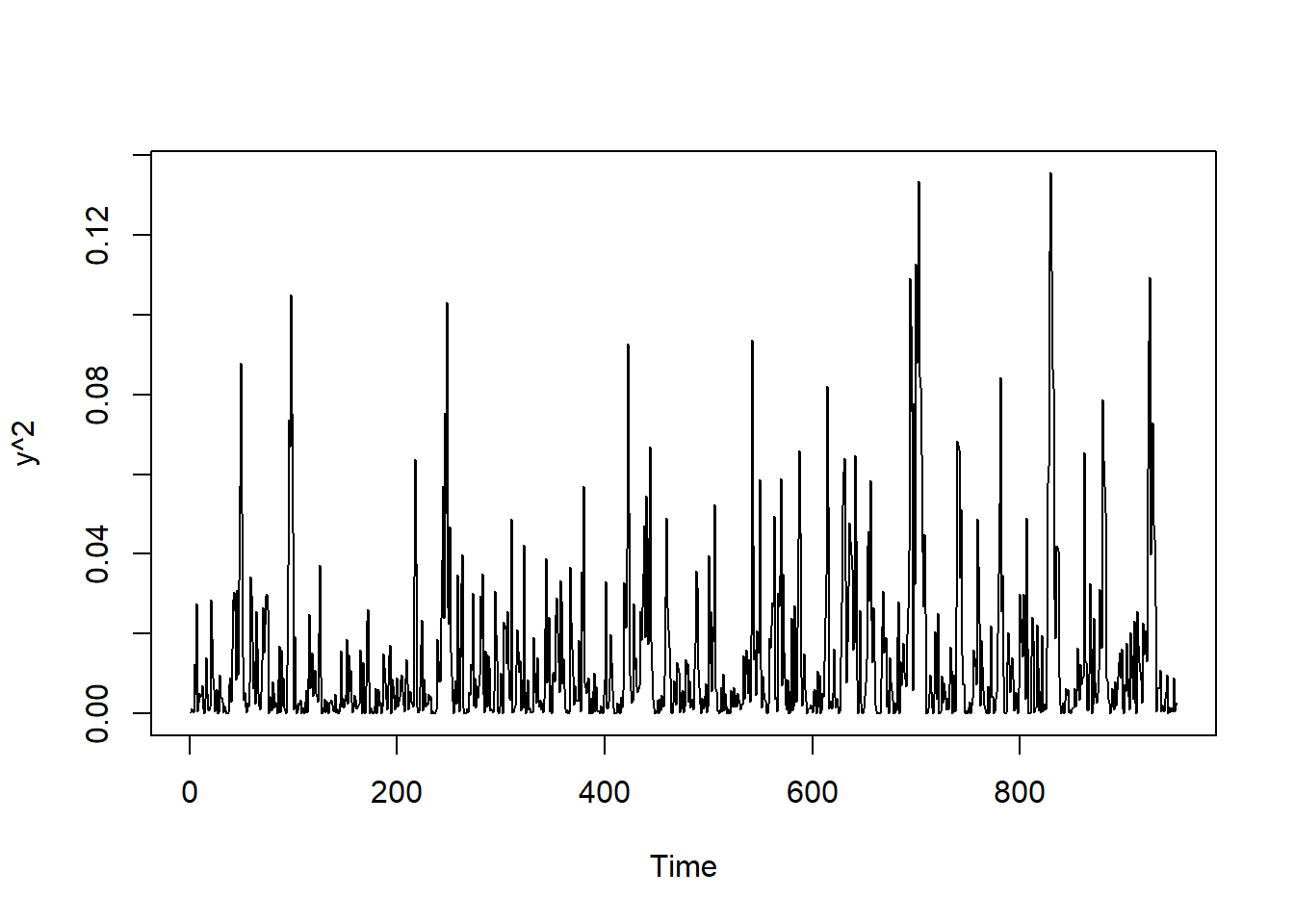

## Simulate data from ARMA(1,1)-TGARCH(1,1) process

# set parameters

t_max <- 1000

c <- 0

phi <- 0.85

theta <- -0.1

omega <- 0.01

alpha <- 0.1

beta <- 0.85

gamma <- 0.05

# simulate

set.seed(123)

z <- rnorm(t_max)

epsilon <- c(0, rep(NA, t_max))

sigma2 <- c(1, rep(NA, t_max))

y <- c(sigma2[1]*z[1], rep(NA, t_max))

for (t in 2:(t_max+1)) {

set.seed(t*212) # for reproducibility

sigma2[t] <- omega + alpha*epsilon[t-1]^2 + beta*sigma2[t-1] + gamma*epsilon[t-1]^2*(epsilon[t-1]<0)

epsilon[t] <- sigma2[t]*z[t]

y[t] <- c + phi*y[t-1] + theta*epsilon[t-1] + epsilon[t]

}

y <- y[50:t_max]

## filter

arma11tgarch11_filter <- function(y, params){

# initializations

c <- params[1]

phi <- params[2]

theta <- params[3]

omega <- params[4]

alpha <- params[5]

beta <- params[6]

gamma <- params[7]

t_max <- length(y)

eps <- c(0, rep(NA, t_max-1))

sig2 <- c(1, rep(NA, t_max-1))

z <- rep(NA, t_max)

loglik <- 0

sig2[1] <- var(y)

z[1] <- y[1]/sqrt(sig2[1])

# for loop calculating one-step-ahead

for (t in 2:t_max){

eps[t] <- y[t] - c - phi*y[t-1] - theta*eps[t-1]

sig2[t] <- omega + alpha*eps[t-1]^2 + beta*sig2[t-1] + gamma*eps[t-1]^2*(eps[t-1]<0)

z[t] <- eps[t]/sqrt(sig2[t])

}

# loglik

loglik <- - sum(log(sqrt(sig2[2:t_max]))) - sum(eps[2:t_max]^2/sig2[2:t_max]) # *0.5 + constant terms

# output

return(list(sig2 = sig2,

eps = eps,

z = z,

loglik = loglik))

}## likelihood

arma11tgarch11_objective <- function(y, params) {

#initializations

c <- params[1]

phi <- params[2]

theta <- params[3]

omega <- params[4]

alpha <- params[5]

beta <- params[6]

gamma <- params[7]

t_max <- length(y)

res_filter <- arma11tgarch11_filter(y, params)

sig2 <- res_filter$sig2

eps <- res_filter$eps

# if-else statement calculating negative loglik

# if (all(is.finite(params)) & omega>=0 & alpha>0 & beta>0 & gamma>0 & (alpha+beta+gamma/2)<1) {

if (all(is.finite(params)) & (alpha+beta+gamma/2)<1) {

neg_loglik <- -res_filter$loglik

} else {

neg_loglik <- Inf

}

return(neg_loglik)

}## MLE

arma11tgarch11_mle <- function(y, params) {

# nlminb function optimizing parameters

fit <- nlminb(start = params, objective = arma11tgarch11_objective,

y = y,

lower = c(-1, -0.999, -0.999, -1, 0.01, 0.01, 0.001),

upper = c( 1, 0.999, 0.999, 1, 0.9, 0.9, 0.9))

## output

names(fit$par) <- c("c", "phi", "theta", "omega", "alpha", "beta", "gamma")

fit$par

}tab <- cbind(MLE = mle,

true = c(c, phi, theta, omega, alpha, beta, gamma))

row.names(tab) <- c("c", "phi", "theta", "omega", "alpha", "beta", "gamma")

round(tab, 3)## MLE true

## c 0.001 0.00

## phi 0.837 0.85

## theta -0.121 -0.10

## omega 0.010 0.01

## alpha 0.010 0.10

## beta 0.010 0.85

## gamma 0.082 0.057.2 Modeling the S&P 500 volatility

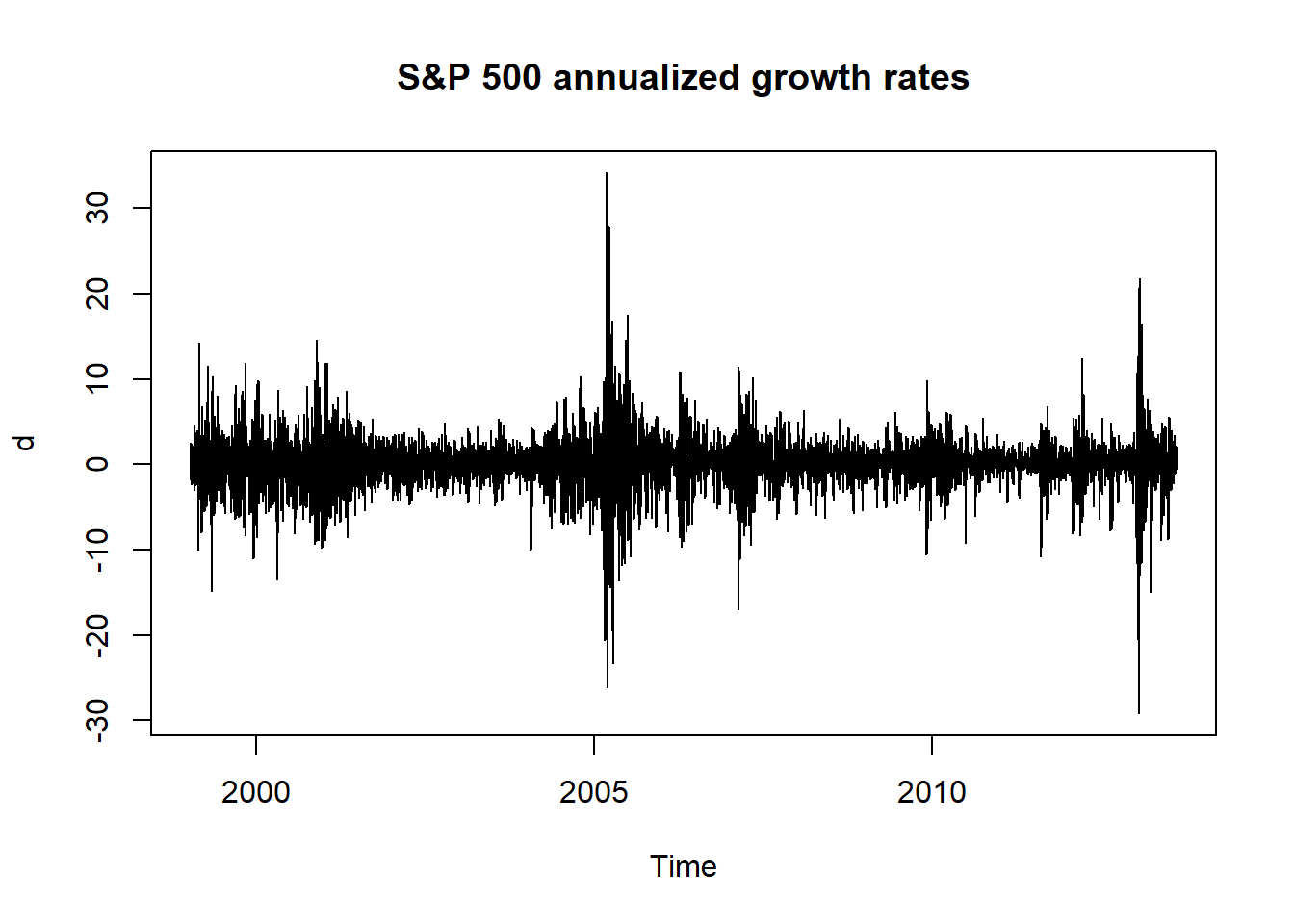

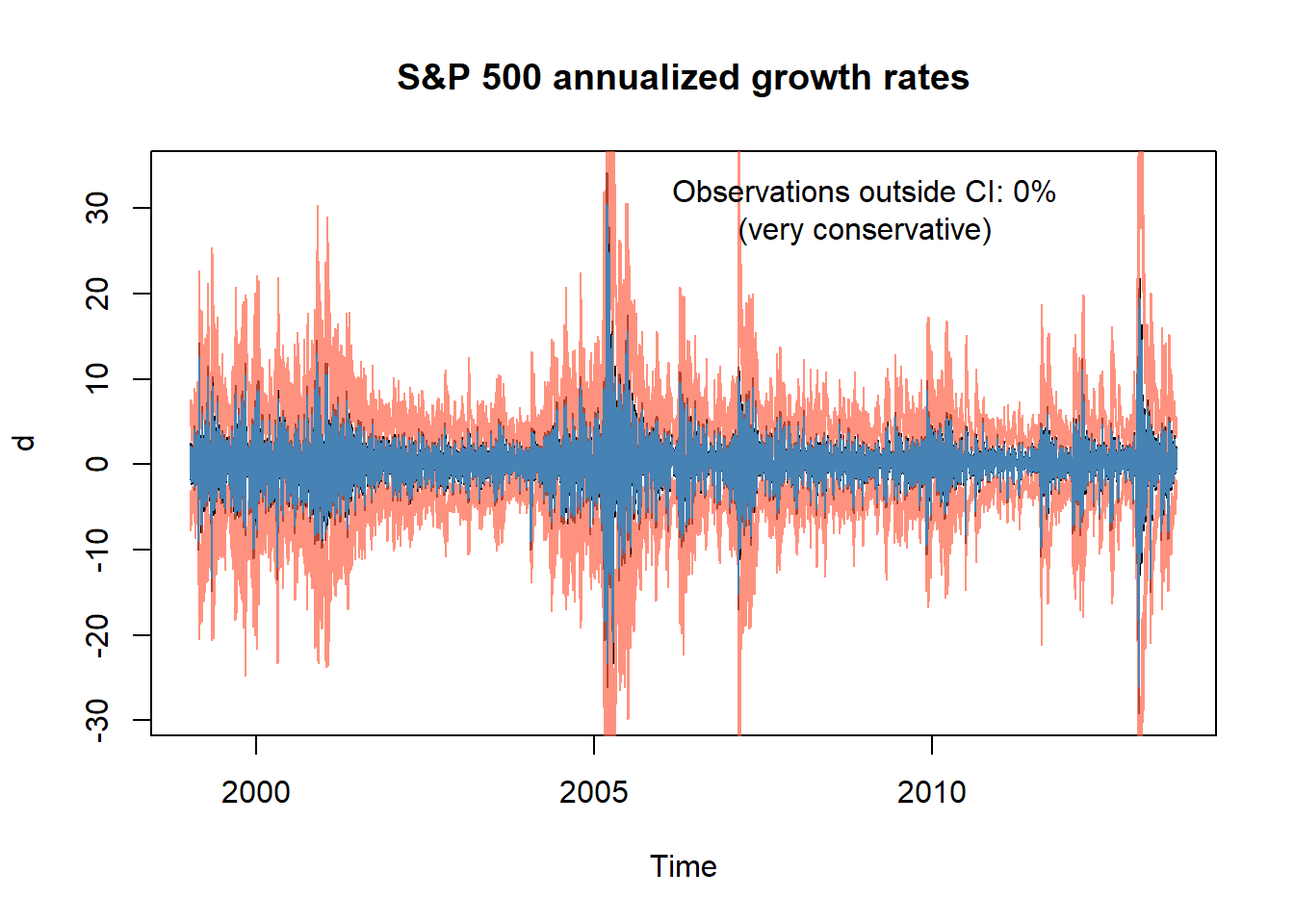

We now show an application of the ARMA(1,1)-TGARCH(1,1) model to the S&P 500 historical data.

## Load data

sp500 <- read.csv("../data/sp500.csv")

sp500 <- ts(sp500$adjusted_close[nrow(sp500):1], start = c(1999, 11, 1), freq = 365)

d <- diff(log(sp500))*252

plot.ts(d, main = "S&P 500 annualized growth rates")

## c phi theta omega alpha

## 0.0003244686 0.8959449229 -0.0037841937 0.1090527671 0.1442490502

## beta gamma

## 0.8394995899 0.0325027199## plot fitted values

filter_sp500 <- arma11tgarch11_filter(d, mle_sp500)

eps <- filter_sp500$eps

sig2 <- filter_sp500$sig2

z <- filter_sp500$z

c <- mle_sp500[1]

phi <- mle_sp500[2]

theta <- mle_sp500[3]

omega <- mle_sp500[4]

alpha <- mle_sp500[5]

beta <- mle_sp500[6]

gamma <- mle_sp500[7]

t_max <- length(d)

fitted_sp500 <- c + phi*d + theta*eps

upper_sp500 <- fitted_sp500 + 1.96*sqrt(sig2)

lower_sp500 <- fitted_sp500 - 1.96*sqrt(sig2)plot.ts(d, main = "S&P 500 annualized growth rates")

lines(lower_sp500, col = scales::alpha("tomato", 0.7))

lines(upper_sp500, col = scales::alpha("tomato", 0.7))

lines(fitted_sp500, col = "steelblue")

text(x = 2009, y = 30,

labels = paste0("Observations outside CI: ",

round(mean((d > upper_sp500) | (d < lower_sp500)),4)*100, "%",

"\n(very conservative)"))

7.3 Exercises

Exercise 1 (h-step ahead volatility forecast of the GARCH(1,1))

Consider the GARCH(1,1) model

\[ \begin{aligned} r_t &= \sigma^2_t z_t \\[1ex] \sigma^2_t &= \omega + \alpha r_{t-1}^2 + \beta \sigma^2_{t-1} \end{aligned} \]

Show that

\[ \mathbb{E}[\sigma^2_{t+h} | r_t, \sigma_t] = \begin{cases} \omega + \alpha r_{t}^2 + \beta \sigma^2_t & \qquad \text{if} \quad h=1 \\ \omega \frac{1-(\alpha+\beta)^{h-1}}{1-\alpha-\beta} + (\alpha+\beta)^{h-1} \ \mathbb{E}[\sigma^2_{t+1} | r_t, \sigma_t] & \qquad \text{if} \quad h>1 \end{cases} \]

Exercise 2 (Log-likelihood of the ARMA(p,q)-GARCH(r,s) model)

Consider the following specification of an ARMA model with conditionally-heteroskedastic innovations:

\[ \begin{aligned} y_t &= c + \phi_1 y_{t-1} + \dots + \phi_p y_{t-p} + \theta_1 \varepsilon_{t-1} + \dots + \theta_q \varepsilon_{t-q} + \varepsilon_t \\ \varepsilon_t &= \sigma_t z_t \\ \sigma^2_t &= \omega + \alpha_1 \varepsilon_{t-1}^2 + \dots + \alpha_r \varepsilon_{t-r}^2 + \beta_1 \sigma^2_{t-1} + \dots + \beta_s \sigma^2_{t-s} \end{aligned} \]

Derive the log-likelihood of the model under the assumption that \(z_t \sim \mathcal{N}(0, 1)\). Provide also the filtering procedure used to estimate the latent variables \(\varepsilon_t\) and \(\sigma_t\).

Exercise 3 (Log-likelihood of the ARMA(1,1)-TGARCH(1,1) model)

Consider the following specification of an ARMA model with asymmetric conditionally-heteroskedastic innovations:

\[ \begin{aligned} y_t &= c + \phi y_{t-1} + \theta \varepsilon_{t-1} + \varepsilon_t \\ \varepsilon_t &= \sigma_t z_t \\ \sigma^2_t &= \omega + \alpha \varepsilon_{t-1}^2 + \beta \sigma^2_{t-1} + \gamma \varepsilon_{t-1}^2 \mathbb{1}_{\varepsilon_{t-1}<0} \end{aligned} \]

Derive the log-likelihood of the model under the assumption that \(z_t \sim \mathcal{N}(0, 1)\). Provide also the filtering procedure used to estimate the latent variables \(\varepsilon_t\) and \(\sigma_t\).