Session 5 ARMA models in practice

## load libraries

library(moments)

## function to plot time series

myplot <- function( dates , y , col='darkblue' , t='l' , lwd=2 , ylim=NULL , main=NULL ){

if( is.null(main) ){ par( mar=c(2,2,0.1,0.1) ) }

plot( dates , y , t=t , col=col , lwd=lwd , axes=F , xlab='' , ylab='' , xaxs="i" , ylim=ylim , main=main )

xticks <- axis.Date(1, x=dates, at=seq(dates[1], dates[length(dates)], "year") , lwd=0, lwd.tick=1, tck=0.02)

yticks <- axis(2 , lwd=0, lwd.tick=1, tck=0.02)

axis.Date(3, x=dates, at=seq(dates[1], dates[length(dates)], "year"), lwd=0, lwd.tick=1, tck=0.02, lab=F)

axis(4, lwd=0, lwd.tick=1, tck=0.02, lab=F)

abline( h=yticks , lty=3 )

abline( v=xticks , lty=3 )

box()

}5.1 Forecasting the U.S. GDP growth

In this session we consider an application of ARMA models to forecasting the U.S. GDP growth rates.

## Load U.S. GDP growth rate

D <- read.table('../data/gdp-us-grate.csv')

dates <- as.Date(as.character(D[,1]),'%Y-%m-%d')

## Setup

H <- 6 # predict 1,2,...,H steps ahead

N <- nrow(D)-6

y <- D[1:N,2]

y.out <-D[(N+1):(N+H),2]##

## Box-Ljung test

##

## data: y

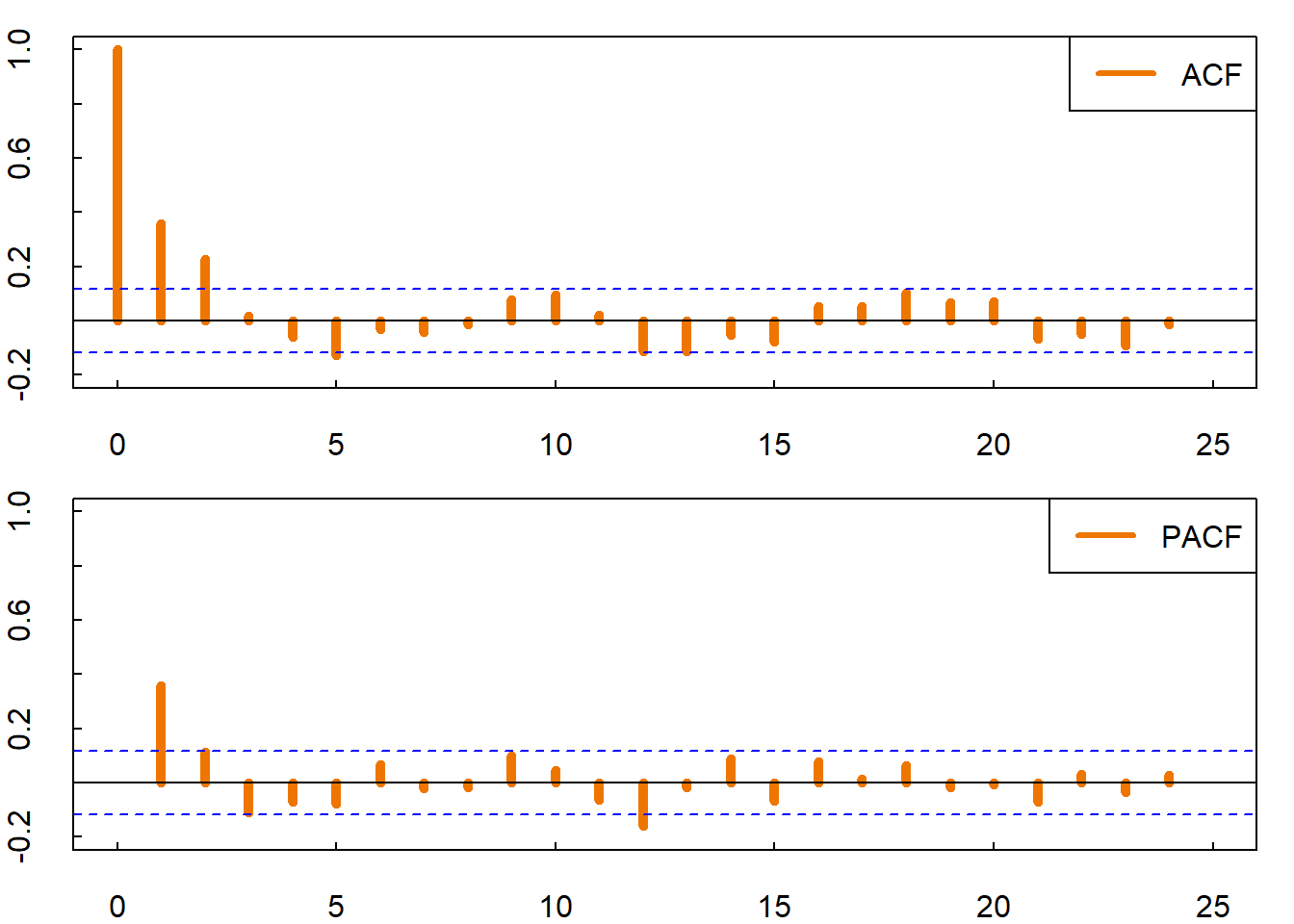

## X-squared = 82.561, df = 22, p-value = 6.112e-09# ACF & PACF

par( mar=c(2,2,1,1) , mfrow=c(2,1) )

acf( y , ylim=c(-0.2,1) , lwd=5 , xlim=c(0,25) , col='darkorange2' , tck=0.02)

legend('topright',c('ACF'),col=c('darkorange2'),lwd=3)

pacf( y , ylim=c(-0.2,1) , lwd=5 , xlim=c(0,25) , col='darkorange2' , tck=0.02)

legend('topright',c('PACF'),col=c('darkorange2'),lwd=3)

Estimation

ar1 <- arima(y,order=c(1,0,0))

ma1 <- arima(y,order=c(0,0,1))

ma2 <- arima(y,order=c(0,0,2))

arma11 <- arima(y,order=c(1,0,1))

# Information criteria

ar1_aic <- (-2*ar1$loglik+2*3)/N # (constant, phi, sigma_e)

ma1_aic <- (-2*ma1$loglik+2*3)/N # (constant, theta, sigma_e)

ma2_aic <- (-2*ma2$loglik+2*4)/N # (constant, theta1, theta2, sigma_e)

arma11_aic <- (-2*arma11$loglik+2*4)/N # (constant, phi, theta, sigma_e)

ar1_bic <- (-2*ar1$loglik+log(N)*3)/N

ma1_bic <- (-2*ma1$loglik+log(N)*3)/N

ma2_bic <- (-2*ma2$loglik+log(N)*4)/N

arma11_bic <- (-2*arma11$loglik+log(N)*4)/N

## table of likelihood and ICs

tab1 <- round( rbind( c(ar1$loglik,ma1$loglik.ma2$loglik,arma11$loglik),

c(ar1_aic,ma1_aic,ma2_aic,arma11_aic) ,

c(ar1_bic,ma1_bic,ma2_bic,arma11_bic) ) , 3 )

row.names(tab1) <- c("loglik", "AIC", "BIC")

colnames(tab1) <- c("AR(1)", "MA(1)", "MA(2)", "ARMA(1,1)")

tab1## AR(1) MA(1) MA(2) ARMA(1,1)

## loglik -747.736 -746.702 -747.736 -746.702

## AIC 5.382 5.419 5.371 5.381

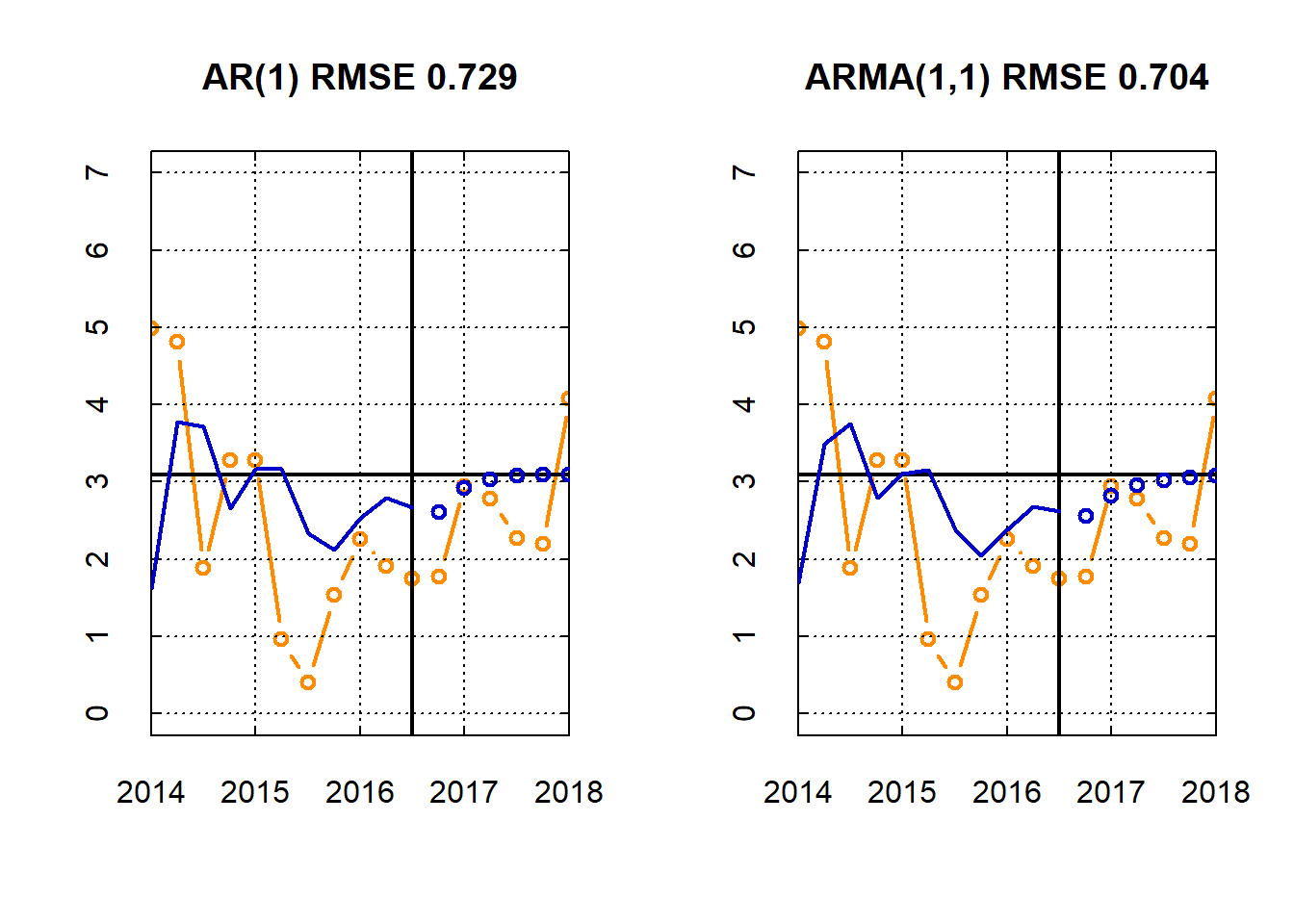

## BIC 5.421 5.458 5.423 5.433Forecasting

## get forecasts

ar1_pred <- predict(ar1, n.ahead=H)

ma1_pred <- predict(ma1, n.ahead=H)

ma2_pred <- predict(ma2, n.ahead=H)

arma11_pred <- predict(arma11, n.ahead=H)

## get fitted values

ar1_mu <- y-ar1$residuals

ma1_mu <- y-ma1$residuals

ma2_mu <- y-ma2$residuals

arma11_mu <- y-arma11$residuals

## compute RMSE

rmse <- function(y, f) {sqrt(mean((y-as.numeric(f))^2))}

ar1_mse <-rmse(y.out, ar1_pred$pred)

ma1_mse <-rmse(y.out, ma1_pred$pred)

ma2_mse <-rmse(y.out, ma2_pred$pred)

arma11_mse <-rmse(y.out, arma11_pred$pred)

## Plot

par(mfrow = c(1,2))

myplot( dates[(N-10):(N+H)] , c(y[(N-10):N], y.out) , t='b', main=sprintf('AR(1) RMSE %3.3f',ar1_mse) , ylim=c(0,7) , col='darkorange' )

abline( v=dates[N] , lwd=2 )

abline( h=ar1$coef['intercept'] , lwd=2 )

lines( dates[(N-10):N] , ar1_mu[(N-10):N] , t='l' , lwd=2 , col='blue3' )

lines( dates[(N+1):(N+H)] , as.numeric(ar1_pred$pred) , t='b' , lwd=2 , col='blue3' )

myplot( dates[(N-10):(N+H)] , c(y[(N-10):N], y.out) , t='b' , main=sprintf('ARMA(1,1) RMSE %3.3f',arma11_mse) , ylim=c(0,7) , col='darkorange' )

abline( v=dates[N] , lwd=2 )

abline( h=arma11$coef['intercept'] , lwd=2 )

lines( dates[(N-10):N] , arma11_mu[(N-10):N] , t='l' , lwd=2 , col='blue3' )

lines( dates[(N+1):(N+H)] , as.numeric(arma11_pred$pred) , t='b' , lwd=2 , col='blue3' )

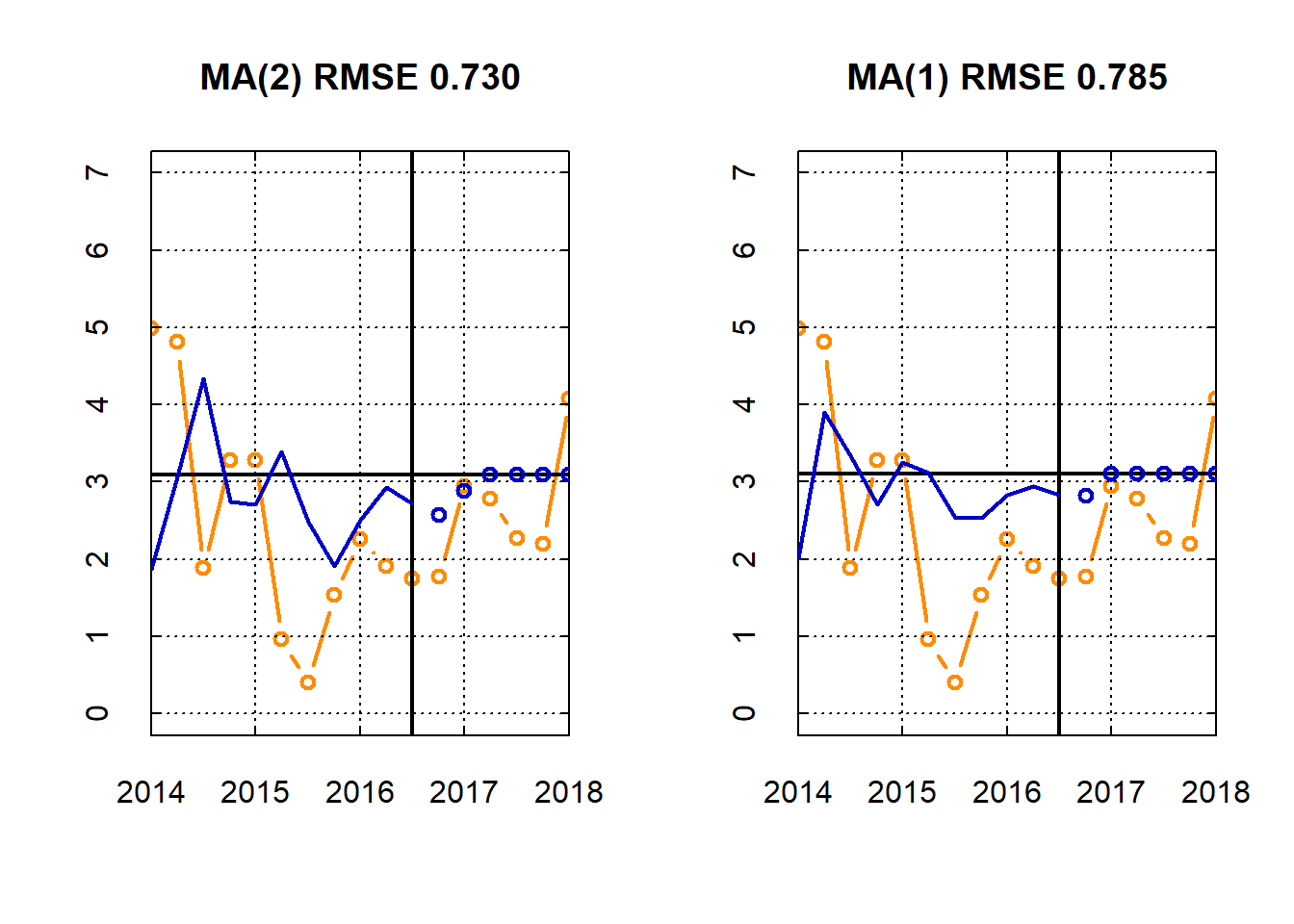

par(mfrow = c(1,2))

myplot( dates[(N-10):(N+H)] , c(y[(N-10):N], y.out) , t='b', main=sprintf('MA(2) RMSE %3.3f',ma2_mse) , ylim=c(0,7) , col='darkorange' )

abline( v=dates[N] , lwd=2 )

abline( h=ma2$coef['intercept'] , lwd=2 )

lines( dates[(N-10):N] , ma2_mu[(N-10):N] , t='l' , lwd=2 , col='blue3' )

lines( dates[(N+1):(N+H)] , as.numeric(ma2_pred$pred) , t='b' , lwd=2 , col='blue3' )

myplot( dates[(N-10):(N+H)] , c(y[(N-10):N], y.out) , t='b' , main=sprintf('MA(1) RMSE %3.3f',ma1_mse) , ylim=c(0,7) , col='darkorange' )

abline( v=dates[N] , lwd=2 )

abline( h=ma1$coef['intercept'] , lwd=2 )

lines( dates[(N-10):N] , ma1_mu[(N-10):N] , t='l' , lwd=2 , col='blue3' )

lines( dates[(N+1):(N+H)] , as.numeric(ma1_pred$pred) , t='b' , lwd=2 , col='blue3' )

5.2 Exercises

Exercise 1 (Best forecast under the square loss)

Show that the best forecast under the square loss \[ L(y_{t+h}, \ \hat{y}_{t+h|t}) = (y_{t+h}-\hat{y}_{t+h|t})^2 \]

for some forecast horizon \(h \in \mathbb{N}\) is \[ \hat{y}_{t+h|t} = \mathbb{E} [y_{t+h} \ | \ y_t, \dots, y_1] \]

Exercise 2 (Best forecast under the absolute loss)

Show that the best forecast under the absolute loss \[ L(y_{t+h}, \ \hat{y}_{t+h|t}) = |y_{t+h}-\hat{y}_{t+h|t}| \]

for some forecast horizon \(h \in \mathbb{N}\) is \[ \hat{y}_{t+h|t} = \text{median}(y_{t+h} \ | \ y_t, \dots, y_1) \]

Exercise 3 (Invertibility of MA(1))

Consider the MA(1) process

\[ y_t = \theta \varepsilon_{t-1} + \varepsilon_t. \]

Show that:

- if \(|\theta|<1\), then the process is invertible in the past observed values:

\[ \varepsilon_t = \sum_{j=0}^{\infty} (-\theta)^j y_{t-j} \]

- if \(|\theta|>1\), then the process is invertible in the future observed values:

\[ \varepsilon_t = \frac{1}{\theta} \sum_{j=0}^{\infty} \left(-\frac{1}{\theta}\right)^j y_{t+j+1} \]